Payback on investment formula

Read What Is Capital Budgeting. These articles will teach you must know finance formula.

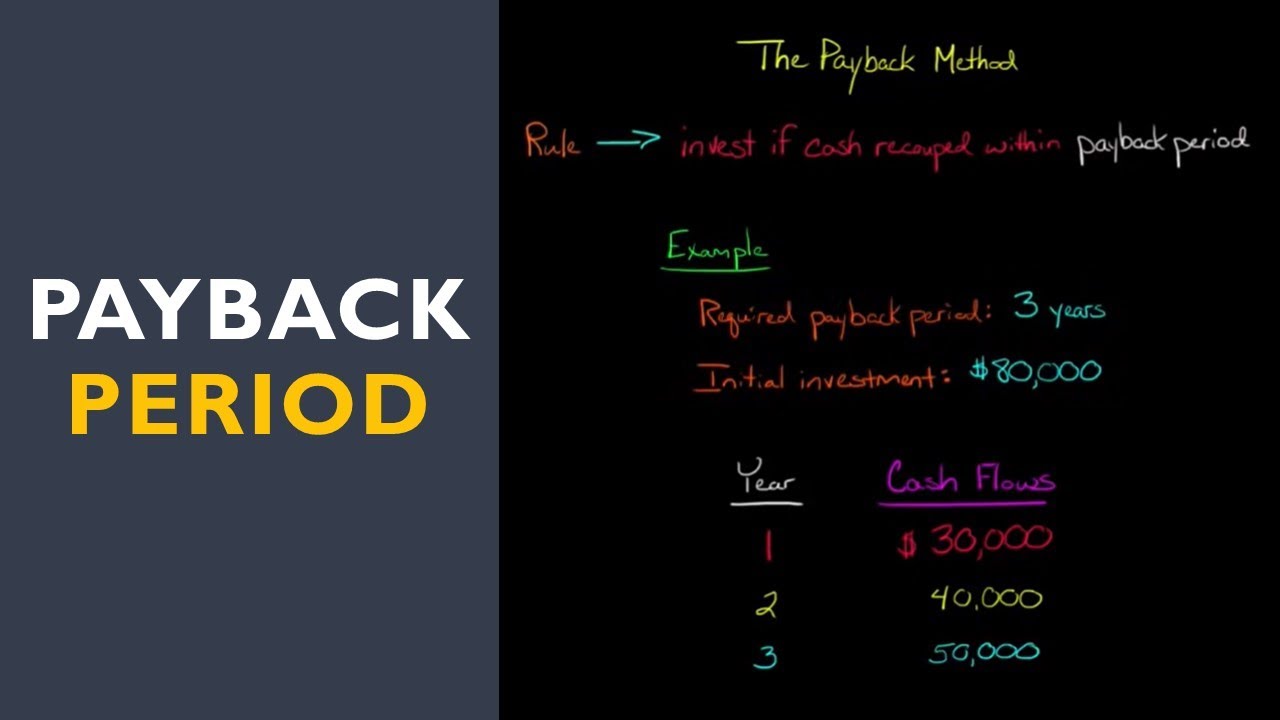

How To Calculate The Payback Period Youtube

The following is an example of determining discounted payback period using the same example as used for determining payback period.

. Discounted Payback Period. Evaluation of the Payback Method. Investment Banking Accounting CFA Calculator others.

The payback period PBP is the time number of years it takes for the cash flows of incomes from a particular project to cover the initial investment. When net annual cash inflow is even ie same cash. Payback Period 1 million 25 lakh.

The payback period is the time required to recover the cost of total investment meant into a business. Cost of capital is the rate of return the firm expects to earn from its investment in order to increase the value of the firm in the market place. A project costs 2Mn and yields a profit of 30000 after depreciation of 10 straight line but before tax of.

Using the Payback Period Formula We get-Payback period Initial Investment or Original Cost of the Asset Cash Inflows. A return on investment ROI for real estate can vary greatly depending on how the property is financed the rental income and the costs involved. When deciding whether to invest in a project or when comparing projects having different.

Say Kapoor Enterprises is considering investments A and B each requiring an investment of Rs 20 Lakhs today and cash flows at the end of each of the following 5 years. The internal rate of return sometime known as yield on project is the rate at which an investment project promises to. Then we compare that against the cost of electricity from the utility company which tells us how long it takes to break even on the system.

The payback technique states how long it takes for the project to generate sufficient cash flow to cover the projects initial cost. To figure out payback period without the solar panel cost calculator we first calculate the true cost of installing solar after incentives have been claimed. Payback Period Example Calculation.

Lets understand the Payback Period Formula and its application with the help of the following example. The Formula for ROI. Payback period means the period of time that a project requires to recover the money invested in it.

The payback method should not be used as the sole criterion for approval of a capital investment. The formula to calculate payback period is. It will depend on various factors like the products utility uniqueness.

First well calculate the metric under the non-discounted approach using the two assumptions below. Let us see an example of how to calculate the payback period when cash flows are uniform over using the full life of the asset. Payback period Formula Total initial capital investment Expected annual after-tax cash inflow.

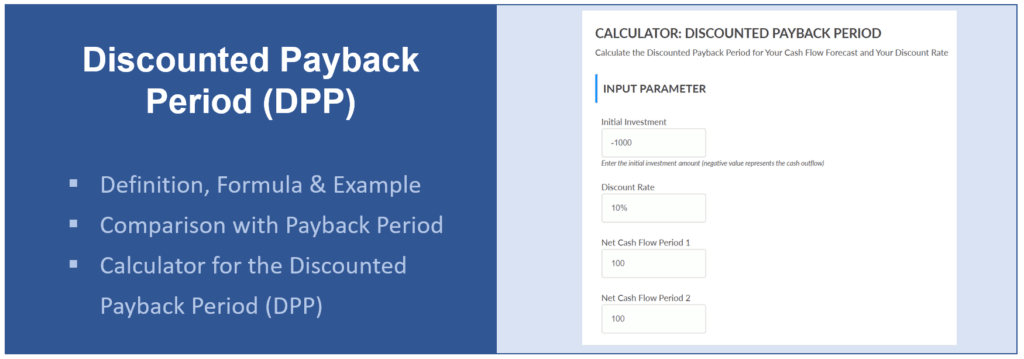

Average Collection Period Formula. Discounted Payback Period Discounted payback period is the time taken to recover the initial cost of investment but it is calculated by discounting all the future cash flows. Payback Period Initial investment.

Between mutually exclusive projects having similar return the decision should be to invest in the project having the shortest payback period. Get all the latest India news ipo bse business news commodity only on Moneycontrol. The payback period is nothing but the time taken to recover the investment amount.

Payback Period 4 years. The formula for capital investment can be derived by using the following steps. It analyzes an investment project by comparing the internal rate of return to the minimum required rate of return of the company.

The formula of ARR is as follows. 10mm Cash Flows Per Year. Payback Period the last year with negative cash flow Amount of cash flow at the end of that year Cash flow during the year after that year Using the subtraction method one starts by subtracting individual annual cash flows from the initial investment amount and then does the division.

A discounted payback period gives the number of years it. The longer the payback period of a project the higher the risk. Next determine the actual selling price of the product at which it is being traded in the market place.

The discounted payback period is a capital budgeting procedure used to determine the profitability of a project. Firstly determine the value of the gross block of the subject company at the start of the period and at the end of the period and is easily available in the balance sheet. The payback period is the length of time required to recover the cost of an investment.

Instead consider using the net present value or internal rate of return methods to incorporate the time value of money and more complex cash flows and use throughput analysis to see if the investment will actually boost overall. Free Finance Formula Calculators guides to learn the most important finance formula at your own pace. Like net present value method internal rate of return IRR method also takes into account the time value of money.

The payback method helps in revealing the payback period of an investment. The payback period of a given investment or project is an important determinant of whether. It does not take into account the time value of money while calculating the time taken to recover the initial cost of investment.

If a 100 investment has an annual payback of 20 and the discount rate is 10 the NPV of the first 20 payback is. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. 4mm Our table lists each of the years in the rows and then has three columns.

It is mostly expressed in months and years. Payback period formula for even cash flow. Next compute the net increase in the gross block by subtracting the.

The first formula for producer surplus can be derived by using the following steps. One of the simplest investment appraisal techniques is the payback period. Firstly determine the minimum at which the producer is willing or able to sell the subject good.

It is also known as return on investment or return on capital. When a CFO faces a choice he will prefer the project with the shortest payback period. Payback Formula Subtraction Method.

This method of calculation does take. Payback Period 3 1119 3 058 36 years. Payback Period Example.

Know about Cost of capital definition formula calculation and example. The payback period. Under payback method an investment project is accepted or rejected on the basis of payback period.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Get 247 customer support help when you place a homework help service order with us.

Undiscounted Payback Period Discounted Payback Period

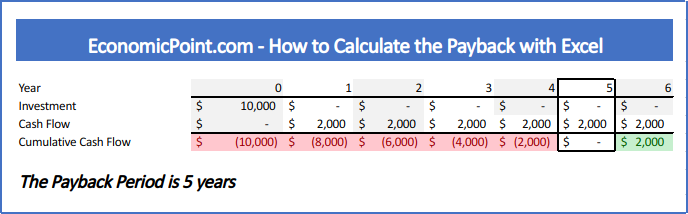

How To Calculate The Payback Period In Excel

Calculate The Payback Period With This Formula

How To Calculate The Payback Period With Excel

Payback Period Business Tutor2u

Payback Period Formula And Calculator Excel Template

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review Youtube

Payback Period Formula And Calculator Excel Template

How To Calculate The Payback Period With Excel

How To Use The Payback Period

Undiscounted Payback Period Discounted Payback Period

What Is Payback Period Formula Calculation Example

Payback Period Method Double Entry Bookkeeping

How To Calculate The Payback Period With Excel

Discounted Payback Period Definition Formula Example Calculator Project Management Info

Payback Period Summary And Forum 12manage

Capital Investment Models Payback Period Youtube